Lagatar24 Desk

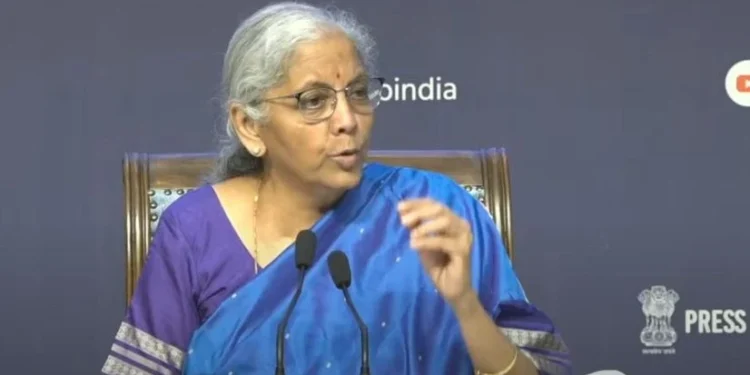

New Delhi: Finance Minister Nirmala Sitharaman has assured that the benefits of the GST rate rationalisation will be passed on to consumers and not pocketed by companies. Speaking on India Today TV in her first interview after announcing the reforms, she stressed that strict monitoring will begin from September 22, when the new tax rates take effect.

“Industry Will Pass It On”

Sitharaman said the government, MPs, and the Central Board of Indirect Taxes and Customs (CBIC) will all monitor how the cuts translate into lower MRPs for essential goods. “The GST cut benefits will be transferred and passed on to the people by industry. If any company says otherwise, we will talk to them. Consumption will increase, and so will incomes,”she said.

Concerns Over Profiteering

Skepticism remains as India currently has no dedicated anti-profiteering body. The National Anti-Profiteering Authority (NAA), set up in 2017, was wound up in 2022, and its functions were shifted first to the Competition Commission of India (CCI) and now to the GST Appellate Tribunal (GSTAT). With no active watchdog, critics worry about companies keeping the tax gains.

However, Revenue Secretary Arvind Shrivastava cited past data to downplay fears, noting that out of 704 profiteering cases worth ₹4,362 crore filed since GST’s launch, nearly 60% were from the early years, and industries generally complied with passing on tax benefits.

Biggest GST Reform Since 2017

The September 3 decision rationalised GST into two main slabs—5% and 18% (with a special 40% for a few luxury or harmful goods). This is expected to make food items, personal care products, textiles, cement, and electronics cheaper, while pan masala and cold drinks get costlier.

Government’s Stand

Sitharaman emphasised that the government’s priority is to ensure “janta ko fayda mile” (the people get the benefit). She said industry leaders have pledged to pass on the savings, and MPs will directly monitor reductions at the ground level.